Litecoin (LTC) price has been trending higher, over the last week, climbing from around $76 to $86.70 at the time of writing.

As it cruised past the crucial $80 resistance level, as a deciding factor for future directional movement, it inspired hope for surpassing $100.

The next major support zone would emerge at $96 after bulls succeed in a sustained break above $80.

Analysts identified potential bullish continuation potential from the $68 price floor because price reactions showed rejection before starting its upwards movement.

An ascending movement toward $96 to signify growing bull market strength would be more significant when higher trading volume occurs.

Insufficient price maintenance at $80 would generate rejection that drives Litecoin back toward its $68 support base.

Litecoin price faces additional downward risks if it drops below $68 support because the next potential sturdy resistance sits at $56.

LTC 1-hour price action chart | source: X

The extended market movement continued to follow the persistent descending trendline. Litecoin price opened this year near $140 before reaching $125, maintaining a downward directional pressure.

Such a descending trendline exists to suppress future market recovery waves until it gets broken decisively.

Multiple bearish highs in the market structure supported the dominance of sellers across the medium-term span.

The LTC price movement continues building momentum reaching a peak of over $87 earlier today.

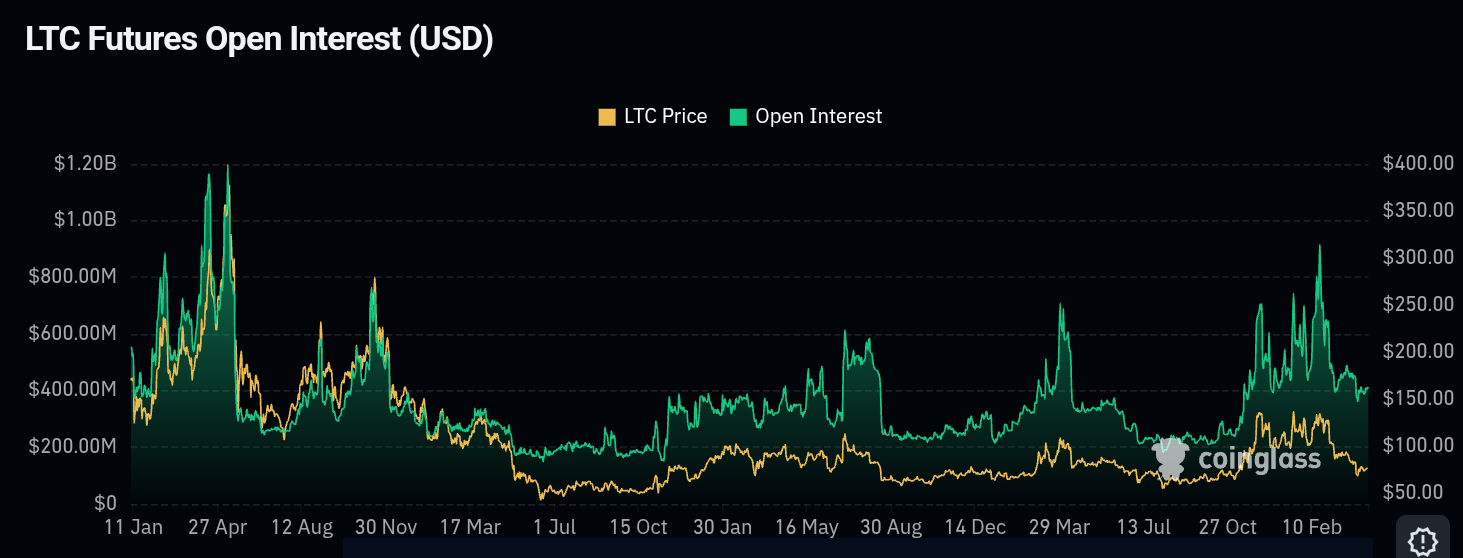

LTC Open interest hit $314 million

The open interest of Litecoin futures skyrocketed to attain a substantial peak of $401.64 million before dipping to $314 million at press time.

The market’s notable growth coincided with traders taking positions because they expected possible short-term price movements.

The number of traders that held Litecoin futures contracts stayed below $300 million during previous periods because market participation was low.

LTC prices stayed within the range between $50 and $150 while open interest numbers grew consistently.

Data from the chart demonstrated that open interest regularly rose when prices reached the upper range especially when exceeding $100 indicating increased market belief in price volatility.

LTC open interest chart | Source: Coinglass

The market moved $401.64 million higher to demonstrate expectations regarding Litecoin price breaking out or facing important value changes.

Prior to this point in time, increased open interest above $350 million acted as an indicator for LTC price movements exceeding $250 as observed in earlier data.

The elevated open interest appears to show potential for more price changes that could elevate Litecoin prices above the present resistance levels.

Litecoin Among 70+ Crypto ETFs in 2025

The U.S. Securities and Exchange Commission (SEC) had received more than 70 cryptocurrency-based exchange-traded funds (ETFs) applications during the year 2025 including Litecoin.

These include XRP and Solana (SOL) among the major assets along with Litecoin (LTC), Dogecoin (DOGE), Cardano (ADA) and Polkadot (DOT).

The submitted ETF proposals were from different companies including Grayscale, ProShares, and Bitwise.

Increased approval chances of Litecoin might enhance its exposure based on existing multiple filings.

The SEC allocated the entire review timeline of 2025 into different quarters starting from this year.

Multiple ETF applications submitted to the SEC will reach their final deadline throughout May until December 2025.

Chart showing ETFs fillings | Source: X

Some ETFs encounter delays, yet additional proposals might succeed based on market situations combined with SEC’s attitude towards their support.

While progress may slow down significantly if the approval process becomes prolonged, 2025 might become a critical juncture for blockchain acceptance.

Leave a Reply