While the broader crypto market enjoyed steady gains last week, the stablecoin sector expanded notably, contributing an additional $4.581 billion to the fiat-linked crypto ecosystem.

Fiat-Linked Tokens Expand Amid Market Volatility

As of press time on Sunday, the stablecoin economy holds a valuation of $239.108 billion, requiring an additional $892 million to surpass the $240 billion threshold. According to defillama.com data, the stablecoin sector expanded by 1.96% this week, measured since April 20, 2025.

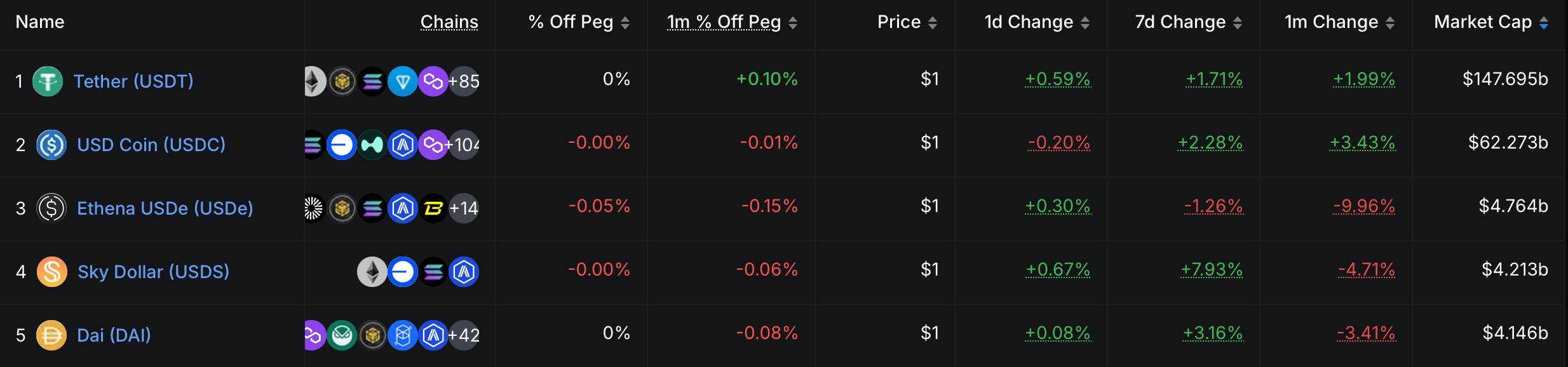

Top five stablecoins by market cap as of April 27, 2025, according to defillama.com metrics.

This jump reflected a $4.581 billion increase in value over that span. Tether, the dominant force among stablecoins, witnessed its USDT supply grow to $147.695 billion, marking a 1.71% gain. Circle’s USDC advanced by 2.28% over the seven-day period, bringing its market cap to $62.273 billion.

Ethena’s USDe, however, contracted this week, slipping 1.26%, while over the past month, USDe’s supply shrank by 9.96%. As of April 27, USDe’s total market valuation sits at approximately $4.764 billion. Among the top ten by market capitalization, Sky’s USDS experienced the greatest growth this week, climbing 7.93%.

Currently, USDS’s market cap is positioned at $4.213 billion. DAI improved by 3.16%, while Blackrock’s BUIDL edged higher by 3.49%. DAI’s valuation now stands at $4.146 billion, with BUIDL reaching $2.536 billion on April 27. Other notable risers this week included Tron’s USDD, which advanced 12.62%, and Ripple’s RLUSD, which grew 7.91%.

The Ripple-issued stablecoin now carries a market cap of roughly $317.04 million. The stablecoin sector’s steady climb illustrates its crucial position within crypto markets, as leading tokens like USDT and USDC continue to strengthen their hold amid a spectrum of performances.

Although certain assets experienced decline, rising contenders such as USDS and RLUSD hint at evolving market dynamics. This expansion, now approaching the $240 billion mark, attests to the lasting significance of stablecoins in the face of broader market fluctuations.

Leave a Reply