The investment firm BlackRock purchased $54 million worth of Ethereum (ETH), according to Crypto Rover. The transaction serves as a major institutional approval from the world’s biggest asset manager, generating short-term market shifts and strengthening ETH’s appeal to institutional investors.

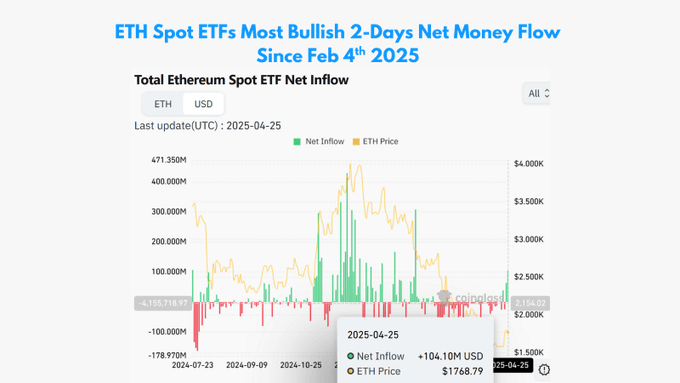

A surge in spot Ethereum ETF inflows coincides with the changing United States regulatory reforms. Analysts view this shift as an optimistic sign, as spot Ethereum ETF inflows continue to rise and trading volumes surge to match a positive week of ETF inflows not seen since February. Market participants monitor Ethereum’s ability to maintain its critical $1,800 support area and establish a large-scale market recovery.

Ethereum Trading Activity and Market Metrics Strengthen

Ethereum (ETH) trades at $1,807.19 at press time, showing a daily market growth of 1.38%. This asset’s market capitalization reaches $218.16 billion, while its 24-hour trading volume amounts to $17.08 billion and marks a substantial 29.95% growth. This surge in activity frequently indicates a spike in volatility ahead, a warning for bulls and bears.

Related: Ethereum Whale Borrows 4,000 ETH on Aave to Initiate New Short Position

Ethereum’s short-term outlook depends on its ability to hold above $1,800. If this support holds, a further test toward $1,830—and possibly $1,850—would become more likely. On the other hand, if there is a decisive break below $1,790, ETH could be exposed to further downside risk toward $1,760 or even $1,720.

BlackRock’s Strategic Timing Amid Political Shifts

The acquisition by BlackRock indicates rising interest from institutional investors in purchasing Ethereum-based investment products. Data from SoSoValue shows US spot Ethereum ETFs recorded net inflows of $157.1 million in the previous week and $104.1 million on Friday, marking the first positive flows since February.

Source: Coinglass

The ETHA product from BlackRock recorded $54.43 million inflows while surpassing the performance of FETH from Fidelity and ETHE from Grayscale. In addition, President Trump’s softened rhetoric regarding China tariffs and the appointment of Paul Atkins, a crypto-friendly figure, as SEC Chair have significantly improved sentiment among institutional investors.

Related: Ethereum Whales Stack 449K ETH in a Day, but $1,895 Resistance Holds Firm

The new Chairman of the SEC, Atkins, takes a supportive approach toward digital assets, planning to develop “reasonable and targeted” regulatory guidelines. The political shift toward crypto-friendly regulations creates high expectations for the SEC’s approval of spot ETFs and their staking features.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

📊 + 1.311069 BTC.GET - https://graph.org/Official-donates-from-Binance-04-01?hs=e9a59d00b85b789790d9200f3b9aa84f& 📊

xlwvrl